|

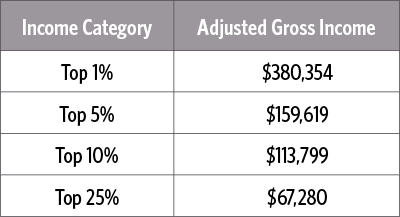

When you think about the amount of income you make on an annual basis, do you consider yourself to be making an average income? What you’ll discover is you may think you’re just like every other individual, but your income may be classified as an “uncommon” amount. Media personalities on the TV or Radio try to get the most amount of exposure they possibly can. This leads to more book sales and more publicity. Just think about it. If you wanted to sell the most amount of books you possibly can, would you target 75% of Americans or just 25%? With this in mind, the financial advice you receive through these media sources are targeting a specific audience: the 75%. The advice they give is very sound and suitable for the audience they’re targeting, but the question really becomes: are you a part of the 75% of the population - or the 25%? If you were to be considered to be in the Top 1% of Americans based on the amount of income you make, how much do you think you would need to make? $1,000,000? $2,000,000? You actually only need to make $380,354. This includes your spouse’s income - if applicable. That’s not a very large amount at all. If you make this amount or more, consider yourself “The Elite” and “The 1%”. The Top 25% Income EarnersSource: Internal Revenue Services 2010-2014 Database The diagram above displays the top 25% of income earners in America. If you make $67,280 or more in annual income, you are the Top 25% of income earners in America. You make an uncommon amount of income compared to the general population. With this in mind, the government then appropriates the amount of taxes you pay for in correlation to the amount of income you make. Therefore, the majority of taxes - a staggering amount of 84% - solely comes from the Top 25% of wage earners. Keep this in mind as you review what you're doing for your financial future. Getting Started For more information and to get started on building a brighter future, please contact us by phone at (909) 944-9421 or via email at [email protected]. |

AuthorWrite something about yourself. No need to be fancy, just an overview. ArchivesCategories |

RSS Feed

RSS Feed

1/30/2018