Social Security Maximization

The greatest fear for most Americans today is not death, but the risk of outliving their assets during retirement – 61% in fact*. If you happen to fall into that statistic, you may be wondering what the best strategy is to maximize your Social Security benefits and create a financial plan that can help minimize your taxes so you can live the prosperous retirement you’ve always dreamed of.

How does Social Security work?The Social Security system is based on a simple premise: Throughout your career, you pay a portion of your earnings into a trust fund by paying Social Security or self-employment taxes. Your employer, if any, contributes an equal amount. In return, you receive certain benefits that can provide income to you when you need it most--at retirement or when you become disabled, for instance.

You can find out more about future Social Security benefits by signing up for a mySocial Security account at the Social Security website, www.ssa.gov, so that you can view your online Social Security Statement. |

|

Understand the real value of Social Security

For most Americans, Social Security will not provide enough income during retirement. However, on average, Social Security accounts for about 40% of income in retirement. This staggering number should not be ignored. Many individuals will be receiving benefits for 25, 30, possibly even 40 years. Social Security provides valuable protection against this “longevity risk”.

|

Don't rush to collect and then regret

You will have the option to collect Social Security between the ages of 62 and 70. Most retirees tend to claim their benefits early and overlook that, once reduction penalties, foregone Delayed Retirement Credits and COLAs are factored in, they could have potentially doubled their initial payments if only they waited until age 70.

|

What is your Full Retirement Age (FRA)?

The amount of your retirement benefit is based on your average earnings over your working career. Higher lifetime earnings result in higher benefits, so if you have some years of no earnings or low earnings, your benefit amount may be lower than if you had worked steadily.

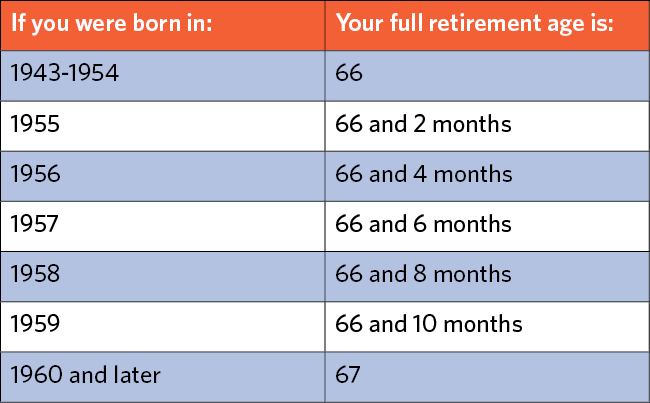

Your age at the time you start receiving benefits also affects your benefit amount. Currently, the full retirement age is in the process of rising to 67 in two-month increments, as shown in the following chart:

Learn more >>

Your age at the time you start receiving benefits also affects your benefit amount. Currently, the full retirement age is in the process of rising to 67 in two-month increments, as shown in the following chart:

Learn more >>

Note: If you were born on January 1 of any year, refer to the previous year to determine your full retirement age.

Free Report: Social Security Maximization

We have spent months building a proprietary system that generates a report informing you on what your optimal retirement age is. In the report, we will show you...

Fill out the form below to receive your free report.

- Projected monthly benefits if you file at that specified age (62-70)

- Comparison of suggested strategy to other common strategies

- A quick guide to the most useful Social Security links

Fill out the form below to receive your free report.

CONNECT WITH US: |

IMPORTANT LINKS: |

LOCATION:FocusStage

10950 Arrow Route #2692 Rancho Cucamonga, CA 91729 Tel: (909) 944-9421 Fax: (909) 297-3233 [email protected] |

Luis Zapata, Financial Advisor in Rancho Cucamonga, CA © 2018 FocusStage | Financial & Insurance Solutions. All rights reserved.