|

The historic volatility combined with the limited availability of traditional retirement income sources, such as defined benefit pension plans, has placed a greater responsibility on Americans savings for their future. With this greater responsibility comes a need for financial solutions that can help provide a new level of protection for retirement savings.

|

Achieve Lifetime IncomeWhether your long-term objective is to build a source of guaranteed lifetime income, save for a specific retirement goal, or leave a legacy for your loved ones, FocusStage can help by offering annuities with benefits designed to meet your retirement needs.

|

How a fixed index annuity works

A fixed index annuity is a contract between you and an insurance company that may help you reach your long-term financial goals. In exchange for your premium payment, the insurance company provides you income, either starting immediately or at some time in the future.

Two unique phasesMost fixed indexed annuities (FIAs) have two phases: an accumulation phase and distribution phase.

|

Minimum guaranteed interestA FIA also guarantees you will receive at least the minimum guaranteed interest credited to the contract.

|

Defer paying taxesWith a FIA, you defer paying taxes on your contract's interest until you receive money from the contract.

|

Phase 1: AccumulationThe accumulation phase begins as soon as you purchase your annuity. Your annuity can earn a fixed rate of interest that is guaranteed by the insurance company or an interest rate based on the growth of an external index. |

Phase 2: DistributionThe distribution phase of a fixed index annuity begins when you choose to receive income payments. You can always take income in the form of scheduled annuitization payments over a period of time, including your lifetime. Many fixed index annuities allow you to take income withdrawals as an alternative to annuitization payments.

|

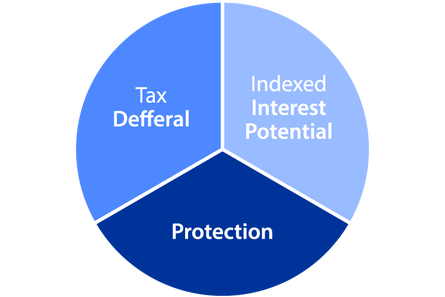

A unique combination of benefits that can help you achieve your long-term goals

A fixed index annuity (FIA) offers a unique combination of benefits that can help you achieve your long-term goals. No other product offers the tax deferral, indexed interest potential, and optional benefits to protect your retirement assets and income. |

Tax Deferral

Under current federal income tax law, any interest earned in your fixed index annuity contract is tax-deferred. You don't have to pay ordinary income taxes on any taxable portion until you begin receiving money from your contract. Withdrawals are taxed as ordinary income and, if taken prior to age 59 1/2, a 10% federal additional tax may apply.

Indexed Interest Potential

Fixed index annuities provide an opportunity for potential interest growth based on changes in one or more indexes. Because of this potential indexed interest, FIAs provide a unique opportunity for accumulation. And since the interest your contract earns is tax-deferred, it may accumulate assets faster. In addition to potential indexed interest, FIAs can offer you an option to receive fixed interest

Protection

Fixed index annuities offer you a level of protection you may find reassuring. That protection can benefit you in three separate ways:

- Accumulation: Your principal and credited interest are protected against market downturns.

- Guaranteed income: You can be protected from the possibility of outliving your assets.

- Death benefit: If you pass away before annuity payments begin, a fixed index annuity may help you provide for your loved ones.

CONNECT WITH US: |

IMPORTANT LINKS: |

LOCATION:FocusStage

10950 Arrow Route #2692 Rancho Cucamonga, CA 91729 Tel: (909) 944-9421 Fax: (909) 297-3233 [email protected] |

Luis Zapata, Financial Advisor in Rancho Cucamonga, CA © 2018 FocusStage | Financial & Insurance Solutions. All rights reserved.