Tax-Free Strategies

How much in taxes do you want to pay in retirement?

If you own any qualified accounts such as 401(k)s or IRAs, you are

already heading toward a substantial tax bill coming due once

you start using those retirement accounts for income.

If you own any qualified accounts such as 401(k)s or IRAs, you are

already heading toward a substantial tax bill coming due once

you start using those retirement accounts for income.

Who exactly are the wealthy?If you make $67,280 or more in annual income, you are the Top 25% of income earners in America. You make an uncommon amount of income compared to the general population and are considered "wealthy".

With this in mind, the government then appropriates the amount of taxes you pay for in correlation to the amount of income you make. Therefore, the majority of taxes - a staggering amount of 84%* - solely comes from the Top 25% of wage earners. * Source: Internal Revenue Services 2010-2014 Database Learn more >> |

Three biggest risks you face during retirement

Stock market volatilityYou may be heavily invested in stocks as they approach retirement which could result in large losses to your investments.

|

LongevityWith improvements to medicine and health care, retirees may live 20-30 years into their retirement and sometimes even longer.

|

Income taxesThe majority of taxes - a staggering amount of 84%* - solely comes from the Top 25% of income wage earners in America.

|

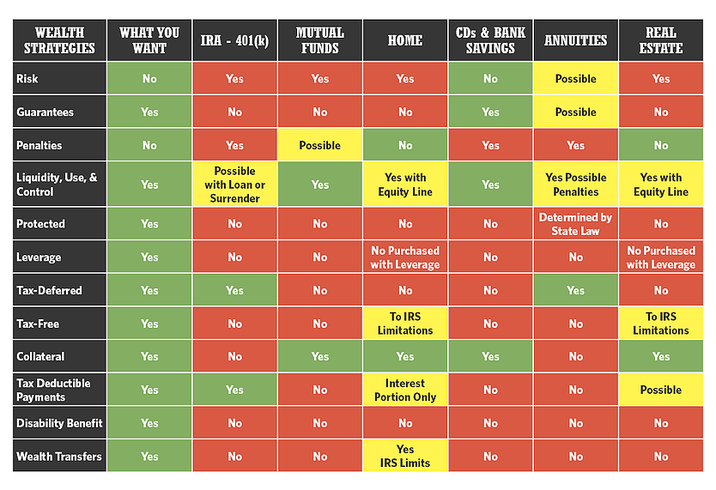

What you want in a financial vehicle isn't

necessarily what you're getting.

In the chart below, you will see everything that you would want in a perfect financial vehicle on the left hand side. We outlined several of the most common accounts that people put their money into to save towards retirement. The "green" signifies matching with what you want while the "red" signifies it does not match your wants. As you can see, most of the common accounts do not align with what you ultimately would want in a financial vehicle.

Free Guide: How to Escape

|

CONNECT WITH US: |

IMPORTANT LINKS: |

LOCATION:FocusStage

10950 Arrow Route #2692 Rancho Cucamonga, CA 91729 Tel: (909) 944-9421 Fax: (909) 297-3233 [email protected] |

Luis Zapata, Financial Advisor in Rancho Cucamonga, CA © 2018 FocusStage | Financial & Insurance Solutions. All rights reserved.